Turnkey – 5 units occupied!

2 units on the main floor. 2 units on the 2nd level. 1 unit on the 3rd level.

Value Add 6th Unit – The lower level walkout basement is a potential 6th unit. The basement already has partial finishes, wiring, a half bathroom that is stubbed for a full bathroom. It needs to be completely for the unit to be rent ready.

Currently the 5 units make up 3,327 sqft of living area. Finishing the 6th unit will add approx 600 sqft of living space bringing the total up to approx 3,927 sqft.

Capital improvements within the past 5 years include exterior paint, roof, windows, plumbing, electric, HVAC, along with several interior cosmetic updates such as tiled floors and backsplashes.

Attached 1 car garage is currently used as maintenance storage. Can be rented separately or with one of the units for additional income. Shared laundry on site for tenants use. Additional large shed on site for owner or tenant storage. Property has private driveway with room for 3-4 parking spaces behind the building.

Current Units & Rent status:

1N: 1 bed 1 bath, occupied at $1183/mo, annual lease

1S: 1 bed 1 bath, occupied at $1,150/mo, annual lease, eligible for rent increase 02.2025

2E: 1 bed 1 bath, occupied at $1,207/mo, annual lease

2W: 2 bed 1 bath with non-confirming 3rd bedroom, currently occupied at $1207/mo, annual lease

3: 1 bed 1 bath currently occupied at $950/mo, month to month lease. Eligible for a rent increase anytime.

B: The walk-out basement can be turned into a 6th living unit that’s 1 bed 1 bath and approx 600 sqft. This unit can include the attached garage for higher rent potential. We estimate a cost of 20-25k to finish the 6th unit.

Utility Meters: 1 water meter, 1 gas meter, 3 electric meters.

Owner Paid Utilities : $1100/mo avg last 12mo.

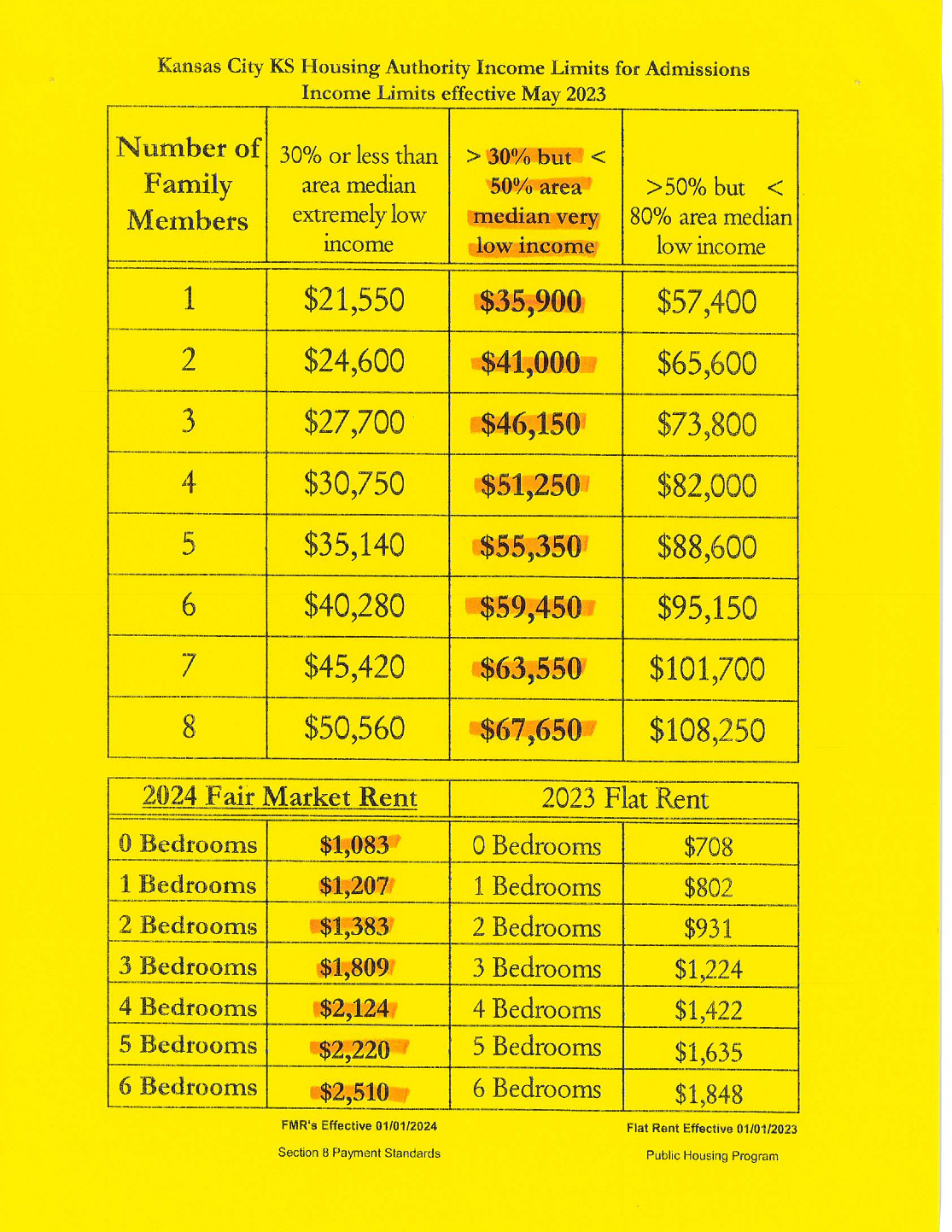

Market rent $1,207 per unit (per Housing Authority, 1bd/1ba units w/ utilities paid KCK HA Website )

Gross rent potential $1,207 X 6 units = $7,242/mo if using all units for LTR (long term rental)

Some of the units could be used for Short Term Rental (AirBnb) or Medium Term Rental (Furnish Finder, Corporate Rental, Extended Stay Rental)

We suggest AirDNA to help forecast performance under the Short Term Rental model.

THE NUMBERS:

$7,242/mo market rent potential after finishing 6th unit

$1100/mo Owner Paid Utilities

$6,142 gross effective rent after utilities

399k purchase + 25k finish 6th unit (approximate)

424k approx total investment

17.4% Gross ROI for finished 6 units

$2550 property taxes for 2024

$1700-2000 insurance quotes from NREIG insurance group

Brokers/Agents welcome with your pre-qualified loan or CASH Buyers!!

Call now to secure this property!

Maddy Morell

Agent – United Real Estate Kansas City

913-712-6811

Maddy@turnkeypropertyusa.com

*These are projections only performance is not guaranteed. All investments have risk and investors should do their own due diligence.